If you or anyone you know drive for Uber, Lyft, or any type of food delivery or passenger transport service, remember to call your insurance agent to verify that you have the coverage you need when performing such a service. To better understand the need to speak with your insurance professional before contracting with a ride service, it is important to understand when coverage gaps may occur on your policy.

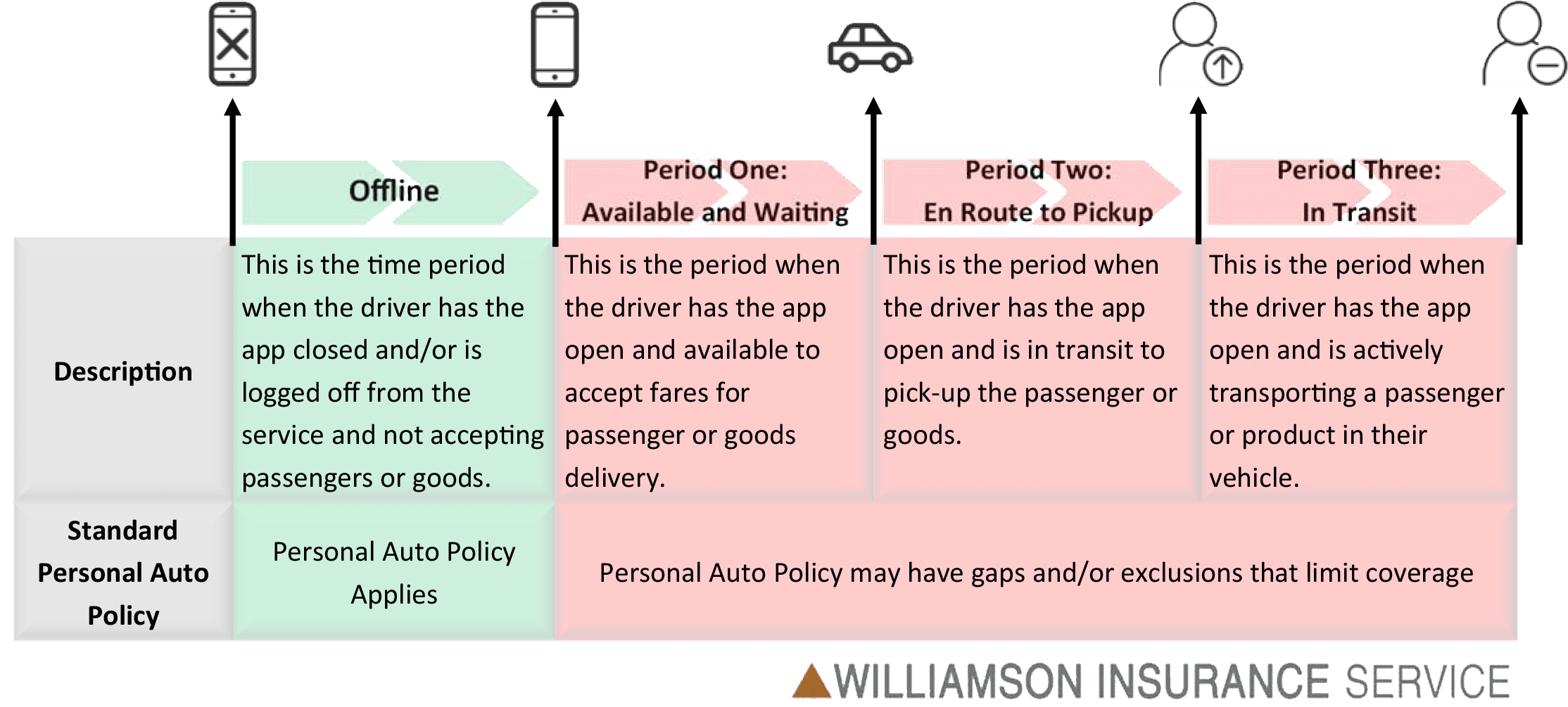

First, there are three periods of driving for any of these services.

- Period One: The mobile app is on, and you are waiting for an assignment to pick-up passengers or goods.

- Phase Two: You are enroute to pick-up the passengers or goods.

- Phase Three: You are in the process of transporting the passengers or goods.

What many people are unaware of is that a standard, unendorsed personal auto policy does not provide coverage during any of the above phases under a normal auto policy. And an unendorsed auto policy might, or might not, provide the coverage in the event you do damage to your car. While services such as Uber and Lyft do cover injury and damage to others while operating as a driver for them, you may be surprised to know that they provide no coverage for your personal auto in the event of a collision. If you are in any of the above phases and experience an auto accident that damages or totals your vehicle, you may have no coverage to repair or replace your auto.

This is where the importance of exploring policies and endorsements available to you as a ride-share driver or delivery person comes into play.

The conclusion: It is not prudent to assume that your personal auto policy will provide coverage for damage to your auto. Do not take on this type of vocation and responsibility without first calling your personal auto insurance agent. With an auto policy that carries an endorsement for ride-share services, there may be some coverage. But even then, not all companies provide the same type of coverage. Explore your options.